A shock Melbourne Cup Day rise in the official cash rate has drawn scorn from retailers and commentators.

The Reserve Bank today raised the rate by another quarter of a per cent to 4.35 per cent, the highest level since 2011, which mainstream media analysts calculate will add another $78 to monthly mortgage repayments on a typical $500,000, 25-year home loan. The increase follows 12 between May last year and June this year, which combined have added $1210 to the cost of servicing a loan that size.

Australian Retailers Association CEO Paul Zahra said previous rate rises had already left retailers reeling, describing the rise as “a significant blow” for the industry heading into the Christmas and holiday trading period and dampening the sector’s cautious optimism.

“Christmas and the holiday season are when discretionary retailers make up to two-thirds of their profits to sustain them during the winter months and hence, they will be devastated by today’s decision.

“Retailers and Australians are already under significant pressure, and Melbourne Cup Day’s rate increase will only pile on further pressure,” Zahra said.

“This rate increase will have a significant impact on discretionary spending, at a time when many retailers are struggling to remain sustainable due to the rising cost of doing business.”

Is stunting retail growth the only solution?, asks NRA

National Retail Association director Rob Godwin said retailers were hopeful the RBA would hold the cash rate at 4.1 per cent, but are now reeling from today’s decision.

“Retailers and consumers feel they’ve been backing the wrong horse as the Reserve Bank looks to take even more money out of our pockets ahead of the biggest sales period of the year,” he said.

“According to the ABS, retail sales volumes are down 1.7 per cent compared to the September quarter last year, proving the 12 previous consecutive rate hikes have been more than effective at curbing consumer spending.

“It begs the question, does the RBA see stunting retail growth as the only solution to easing high inflation even though consumer spending isn’t a key contributing factor?

“Taking money out of the pockets of business owners every time retailers experience a small win isn’t a fair solution to the rising cost of living.”

Rate rise will “decimate” homebuyer activity

Zippy Financial director and principal broker Louisa Sanghera said today’s rise will “decimate homebuyer and investor activity, which has already fallen off a cliff since May last year”.

Sanghera said the increase – the first by newly appointed Reserve Bank governor Michelle Bullock – made no sense given the steadily decreasing inflation over the past nine months as well as the “significant and prolonged fall in homebuyer and investor activity over the same period”.

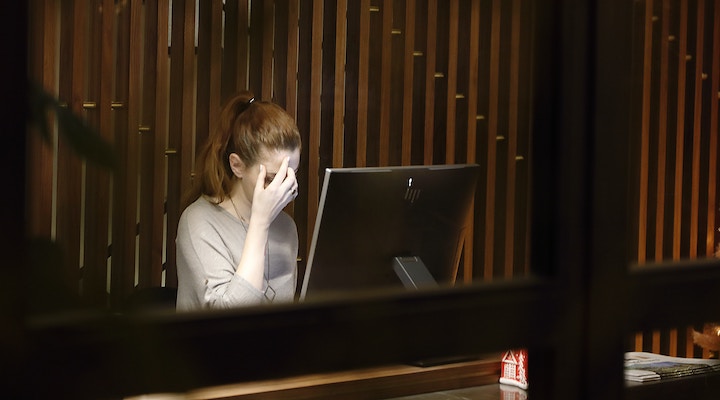

“Many of the new or existing borrowers we speak with have absolutely no chance of refinancing, with a lot of them technically not servicing their current debt levels,” she said.

“Over the past two months in particular, borrowers are becoming more desperate with many homeowners turning to interest-only repayments as the only way they can continue to hold on to their homes.

“Unfortunately, their current lenders don’t necessarily offer interest only to owner occupiers – and they can’t refinance – so they may need to sell or opt for a repayment pause to keep the roof over their heads.”

Sanghera said ABS Lending Indicators for September showed the number of new loans for owner occupiers has fallen 28 per cent since May last year, while the number of new investor loans has fallen 25 per cent over the same period.

She called on “all levels of government” to start showing some fiscal constraint rather than expecting everyday borrowers to shoulder the inflation burden.