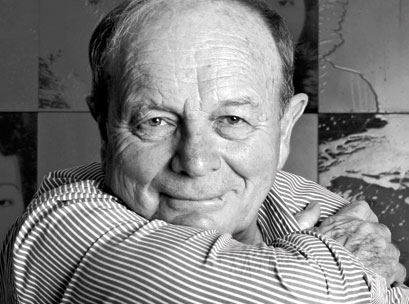

BIO: The name Gerry Harvey has been synonymous with Australian retail for more than 50 years. A door-to-door vacuum cleaner salesman in a previous life, Harvey – alongside fellow cleaner salesman Ian Norman – opened his first retail store in 1961 and hasn’t looked back. He is now the chairman of Harvey Norman, which has evolved into one of the largest retail brands in Australia. Now in his mid-70s, the outspoken entrepreneur continues to steer the ship at the fast-growing company, alongside his wife and CEO Katie Page.

BIO: The name Gerry Harvey has been synonymous with Australian retail for more than 50 years. A door-to-door vacuum cleaner salesman in a previous life, Harvey – alongside fellow cleaner salesman Ian Norman – opened his first retail store in 1961 and hasn’t looked back. He is now the chairman of Harvey Norman, which has evolved into one of the largest retail brands in Australia. Now in his mid-70s, the outspoken entrepreneur continues to steer the ship at the fast-growing company, alongside his wife and CEO Katie Page.

COMPANY PROFILE: From a single Sydney store in 1982, Harvey Norman has evolved into an Australian leader in the furniture, bedding, computers, communications and consumer electronic categories. The company maintains 673 franchised operations in countries around the world, and, during a flat financial year for many major retailers, reported a 30 per cent net profit increase in FY16.

Welcome to 2017, Gerry. How was the Christmas period for Harvey Norman?

Very good. Our sales from July to November were all good and then that continued into December. We had huge sales in some of the stores on Boxing Day, so it was probably as good as we could have expected.

What do you think is driving that?

We did our normal promotions that we do every year, but realistically, nearly every year is better than the one before, it’s just a matter of how much better. During the GFC, we had a year or two where it was a bit behind, but certainly this year has been our best six months ever and the period to the end of December was better than we’ve ever done before in like-for-like sales. They were very good – anywhere where you get above inflation is a good result and we well and truly did that.

That’s poised you well for the upcoming year. How do you think the year will play out?

At this stage all the signs are that 2017 will be a better year than 2016. The share market, unemployment and real estate sales all look good. I know there’s a bit of uncertainty, but when you put the whole package together, I don’t see why it wouldn’t be a very good year. Something will have to happen that we aren’t aware of for it not to be.

Speaking of uncertainty, your market is changing quite a bit. With primary competitors merging and gaining momentum and Amazon reportedly on the horizon, are you doing anything differently to stay on top?

We’ll do what we do and try to do the best we can. We look at who our opposition is every year, so if you’ve been in business for 55 years, you’ve seen lots of people come and go. You’ve seen challenges every year with someone trying to do a better job than you. Everyone is now talking about Amazon coming here and how that will affect us, but I’ve yet to see reason to believe that it will.

A lot of people wouldn’t agree with me, but from my point of view, it will take Amazon forever to set up distribution centres all over Australia and they may never even do it. If I’ve got someone in Perth who wants to buy a fridge or a TV, why would they buy it from a distribution centre in Melbourne or Sydney? If they do, it creates all sorts of problems in terms of delivery and service and last-mile service and so on. In furniture and bedding, they don’t really compete with us, and internet sales in those areas practically don’t exist. The people who are in it are all going broke. In fact, I know of no success stories. Every company looks to me like if they aren’t broke now, they will be soon.

Do you think Amazon has underestimated the unique fulfilment challenges in Australia?

Yeah. It’s a huge difference. When you go to places like London, Singapore, New York and Los Angeles, there are huge numbers of people, so you haven’t got the distance and transport cost problems.

Warehousing costs here are also exceedingly high as well as the quantity of people you need to have in a warehouse to make sure that the right product is sent. This isn’t a walk in the park for Amazon. They’ve made no money in 20 years of selling products. I hear that occasionally there’s a quarter where they’re making money, but they manage to lose it in the next quarter.

So Amazon is this very strange beast that is destroying markets right across the world, or wherever they are. They aren’t making money and they don’t help manufacturers sell their products. There are showrooms closing wherever Amazon goes and suddenly the only way people can buy things is online. There’s a market for online, and we try very hard in that area, but not everyone wants to buy online. Three, four or five per cent might want to buy online and 90-95 per cent want to buy in a shop. Some buy in both. There’s a very small number of people buying exclusively online for everything they purchase.

So Amazon is a threat, but is it a big threat? Is it going to take Harvey Norman to the wall? No, I can live with them.

When we talked last year, you were bullish over your company’s international growth prospects, what are you hoping to do overseas this year?

Our biggest market by a long way is Australia, followed by New Zealand. Asia has been a mixed bag for a long time, but I think, based on what we’ve seen so far, we’ll have our best ever year in Asia across 25-30 shops in Singapore and Malaysia. We’ll do better than we’ve ever done, but we need some momentum somehow to get Asia to produce the results that we see in New Zealand. If we get that then we will move to grow our presence in the market.

Over in Europe, our Irish trade used to lose 60 million a year, then it was 30, 15 and 10. Now in the next year, we’re hoping to make a reasonable profit. We’ve brought some property over there and are now building a big superstore, which should drive things along.

Our Croatian trade is progressing, but not to the degree we’d like to, but if we ever get some momentum up, it’s got the potential to be an extremely good business. When I talk about overseas, there’s the potential there for Harvey Norman, we’ve just got to unlock the key in many places and get things going. In the meantime, while we’ve got that challenge, our business is growing anyway.

Any new countries in the next financial year?

No. Not at the moment. ANZ is something to be proud of, but elsewhere, we need to do better at what we’re doing before we start looking at other countries.

You mentioned that a lot of retailers are going through teething pains with services like click-and-collect at the moment. How is that going for you?

It’s growing our business every year. We’ve pretty much fine-tuned our system now with click-and-collect and people going onto our site and getting information.

One issue is that in a lot of cases, we’ll get a sale and ask whether it happened online or in the shop. It could be both, consumers will go into the shop and have a look then go back to the internet and buy or vice versa. The question is how much of that sale came from in-store or online.

It’s pretty difficult to separate the two, but what we found is that the great majority want to go into the store when they want something to look at it and talk to someone. It’s pretty hard to sit at home all day every day and…never go out and shop. One day, you’ll wake up and say, ‘Well this is a bit boring, I better go out and buy something in a shop’.

Continually, people are spending more time locked to a screen and on all these different apps. In a way, it’s a bit anti-social. So I think somewhere along the line, people will rebel against it. It’s not a fad and it’s not going away, but it has been overhyped an awful lot by people who have a vested interest in trying to do that. It’s achieved a status way beyond where it should be because minority groups are having a big say, even though they only represent two per cent of the population of shoppers.

We’ve seen big pushes towards private label products in some areas and giving brands more control with things like in-store concessions in other areas. How do you feel that’s impacting Harvey Norman?

We spend a lot of time trying to be a good retail partner with manufacturers, but we want to control our own destiny. If a manufacturer has a good idea and they come to us with it, we’ll certainly listen and try to co operate. We would expect them to do the same thing though, so we’re working as partners to develop both our businesses.

Sometimes you might have a difference of opinion, but mostly you don’t because you’re trying to grow.

We’ve also always stuck with the brands more than any other retailer I can think of. When the GFC came along, an awful lot of people went straight to China, whereas we were out there supporting Australian manufacturers, avoiding transitioning to house brands.

There are a lot of people that are, or were, our competitors who went very strongly in that direction. That was their call. They seem to think they can get a brand that’s not a brand that’s better than the brand, and that it will make them more money. They don’t do it for any other reason than more sales.

In 55 years of retailing, most of those people haven’t been successful and most of the people who have stuck with their [original] brands have been successful, I’ve watched it – I’ve learnt this lesson 100 times. I’ll try new things, but I’m not going to leave my brands behind. If I’m Myer, David Jones or another retailer, my future lies in supporting and promoting the big brands.