The launch of a local operation by Amazon would be expected to eat into the growth of existing store-based retailers, if not actually capture some of their sales.

The launch of a local operation by Amazon would be expected to eat into the growth of existing store-based retailers, if not actually capture some of their sales.

But a local operation could potentially do much more damage to online retailers like Kogan as well businesses like Shoes of Prey, Surfstitch and Temple and Webster, which have all struggled recently.

The Seattle-based retailer has reportedly flagged an entry date for a full-scale Australian operation of September 2017, although the ambitious plan would seem to face significant difficulties in rolling that out quickly.

Nonetheless, Amazon seems to have decided to take a move into the Australian market off the backburner.

No doubt Amazon has had a watchful eye on the progress of its fellow Seattle headquartered retailer, Costco, which has passed $1 billion in sales after six years trading in Australia from a handful of stores.

Amazon’s enthusiasm for a move into Australia may also be an attempt to deter the German supermarket chain Lidl from joining Aldi in the local market while also striking as Woolworths and Metcash are in turnaround programs.

Amazon has a good understanding of the Australian market with an existing and apparently expanding customer base.

The retailer apparently believes it can generate up to $4 billion in revenue from Australia within five to six years as consumers increase their online shopping spend.

Amazon is the world’s largest internet retailer with a market capitalisation of $488 billion and annual sales for 2016 likely to tip the scales at around $186 billion.

Amazon effectively generates around one third more sales in its global operations than the total Australian retail market of around $300 billion.

Indeed, its market value exceeds the GDP of Hong Kong and it overtook Walmart as the most valuable retailer in the USA by capitalisation in 2015.

Amazon captures $1 in every $2 spent on internet purchases in the US and, yet while the retailer’s 52-year-old founder and CEO, Jeff Bezos, has net worth of around $114 billion, shareholders are locked into a venture that is based on perpetual expansion and re-investment of funds rather than dividends.

Shares traded on the Nasdaq for Amazon have been hovering around $1,000 apiece with a price earnings multiple of more than 175 and earnings per share of just $5.86 in the September 2016 quarter.

However, there are not a lot of shareholder complaints as the lack of dividend income has been offset for most investors by the capital growth of the stock.

Bezos founded Amazon in 1994, capitalising on the increasing capability of technology and internet platforms to sell books online and subsequently to diversify into DVDs, CDs and videos.

From the outset, Bezos was focused on expansion, market share growth and brand dominance rather than pocketing profits and has ventured into a wide range of products and services.

The retailer now has separate retail websites in Europe, South America, India, China, Japan as well as Australia, where customers are sometimes left frustrated by shipping fees and product availability.

The Amazon business model is based on discount pricing underpinned by its buying power and a lean logistics model that, on the human side of the equation, has sometimes attracted sharp criticism over the expectations and working conditions of employees.

A plan of attack

Entering the Australian market, Amazon would certainly have some competitive advantage with its formidable buying power and should be able to shave its product delivery costs.

But wages, rent and other operational expenses will be higher than stores in other markets, including the USA.

In a more regulated industrial relations framework in Australia, Amazon will need a more velvet glove approach to employees, whose pay packets and entitlements will be much more generous than retailer workers elsewhere.

Higher operating costs will no doubt constrain Amazon’s impact somewhat, but the internet goliath would nevertheless be a fierce new competitor and, of course, its costs profile here would be no worse than for other retailers.

However, Amazon would have some pricing advantages derived from the scale of its product buying and cheaper funding costs for its inventory and the retailer is also likely to offer a broader product range than its local competitors.

Amazon would also derive operational efficiencies from the technology platforms it has developed to underpin its extraordinary and relentless expansion and to enhance customer relationships, as well as ensuring efficient and secure transactions.

Amazon is understood to be keen to expand its operations in Singapore and India in the short-term, but it certainly has the capacity to develop an Australian business at the same time.

Justin Braitling, an investment officer at Watermark Funds Management, claims Amazon plans to open distribution centres in every state in 2017 to provide fulfilment of a broad range of products, apparently including fresh food products.

According to Braitling, Amazon had been planning to launch in Australia in March next year, but has now delayed its entry, while it establishes its distribution hubs and secures supplies.

Braitling has also suggested Amazon will open some stores in Australia as part of its market entry, a proposition that would be consistent with its current strategy in the United States to test three bricks-and-mortar store formats.

The retailer is understood to be looking to roll out Prime, Prime Now and AmazonFresh and it has certainly registered a wider portfolio of trademarks and brands in recent months in Australia.

Notwithstanding the clout of Amazon, a full-scale launch next September would seem problematic and arguably, the retailer could contemplate a staged development of distribution hubs rather than a full national network from the outset.

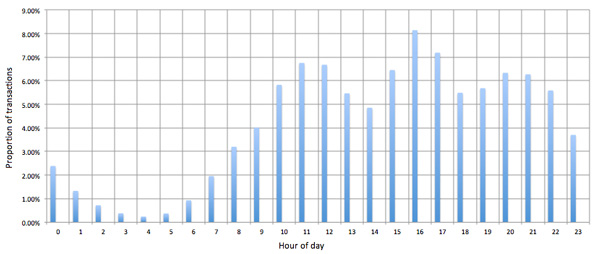

Braitling claims Amazon plans to set its prices at a 30 per cent discount of the prices charged by existing retailers and believes it can lift online retail sales, which are currently around seven to nine per cent of total sales.

The key categories which attract a high proportion of online shoppers are electronics, sports and outdoors, apparel and footwear and entertainment products.

Amazon could limit sales growth for JB Hi-Fi, Harvey Norman, Myer, David Jones, Super Retail Group and fashion retailers such as Premier Retail and Specialty Fashion Group.

Amazon could limit sales growth for JB Hi-Fi, Harvey Norman, Myer, David Jones, Super Retail Group and fashion retailers such as Premier Retail and Specialty Fashion Group.

A fresh food offer could impact on the supermarket chains, particularly if Amazon establishes bricks-and-mortar stores as Braitling claims the retailer has indicated it will do in a briefing with Watermark Funds Management.

Amazon is testing three retail store formats as part of a planned 2,000 store rollout to boost sales of food products which currently only account for about one per cent of online sales in the USA.

The objective of the Amazon Go store format is to focus on the 20 per cent of grocery lines that generate 80 per cent of the sales, however, the business model may be difficult to operate in Australia.

An assault on local retailers

If Amazon does launch in Australia, the most vulnerable local retailers would seem to be pureplay retailers, most of which have struggled to build sales and turn sustainable profits.

Surfstitch has been reeling for months with its shares now priced at the level of penny dreadfuls and with director and management changes and losses of more than $155 million.

Shoes of Prey has been lauded as an online concept and had secured investor support for its expansion in the US market, but recent reports suggest the retailer seems to be burning some of those investment dollars without a commensurate boost in sales and earnings.

Temple and Webster, the online furniture retailer which joined on the Australian Stock Exchange in December 2015 posted a loss of $44 million in its maiden financial result as a listed company for the 2016 full financial year.

Temple and Webster, the online furniture retailer which joined on the Australian Stock Exchange in December 2015 posted a loss of $44 million in its maiden financial result as a listed company for the 2016 full financial year.

While its circumstances are nowhere near as dire as those of Surfstitch, Temple and Webster has similarly changed management in a bid to turnaround the fledgling online store.

Kogan has hardly been a financial whiz in the past two years but, after acquiring the rights to the Dick Smith brand and its customer database, the listed pureplay retailer posted an $11 million gain in sales to $211.2 million for the 2016 financial year.

Kogan bettered its prospectus forecasts with net earnings of $800,000, up from just $100,000 in 2015, but the flagbearer of Australian online retailing who has copied Bezos’ strategy by progressively expanding categories, may need to find some other tricks if Amazon does enter the local market next year.

Access exclusive analysis, locked news and reports with Inside Retail Weekly. Subscribe today and get our premium print publication delivered to your door every week.