Kepler Analytics is in a unique and privileged position. We have our sensors in over 60 retail brands within 1,700 locations across Australia. We collect traffic and other consumer behaviour measures. By aggregating and anonymising our information we can provide the retail industry with benchmark measures on traffic, sales, conversion and other related KPIs focussed on understanding sales and the drivers of retail sales.

Kepler Analytics is in a unique and privileged position. We have our sensors in over 60 retail brands within 1,700 locations across Australia. We collect traffic and other consumer behaviour measures. By aggregating and anonymising our information we can provide the retail industry with benchmark measures on traffic, sales, conversion and other related KPIs focussed on understanding sales and the drivers of retail sales.

The Kepler Retail Radar newsletter is published every 6-8 weeks. We try to keep our analysis relevant and deliver helpful insights which assist in understand historical performance but also highlight where learnings can be implemented to deliver better retail results in future.

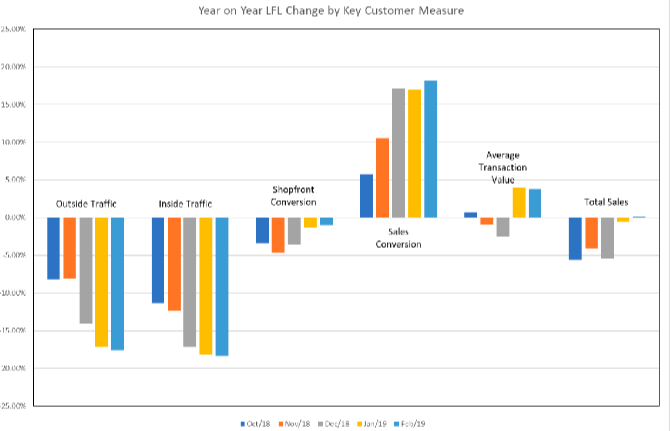

Below are the key learnings from October 2018 to the End of February 2019, calculated on a Year on Year, Like for Like Basis.

- There is a sustained drop in foot traffic into shopping centres in general.

- Those consumers visiting the centres are doing so with a greater propensity to purchase – there is less of a browsing element than in the past.

- Retailers are converting a higher percentage of inside traffic (in store traffic) into sales – due to the more serious nature of the ‘buying trip’ and the greater ability of store staff to satisfy their needs – either there is a lower ratio of staff:customer giving more time to focus on each sale opportunity or better abilities to convert (as these stores have been using the Kepler Conversion Programme for some time).

- The reduction in dwell time and repeat visits and the increase in ATV reaffirm the premise that customers come into stores better equipped to make the purchasing decision than before – it takes less time and less visits to get to the buying decision point.

- Retailers should consider tweaking their sales approach – it might not be a case of ‘how can I help you?’ but rather ‘what can I help you with?’ – subtle change of focus acknowledging the customer can done their homework and is prepared to buy.

Where have all the browsers gone?

The key metrics reveal that whilst centre traffic was down by approximately -8% in October and November (and Black Friday did little to stem the decline), the rate of decline has increased to -17.5% in February

2019.

The desire for customers to enter stores as they pass by (Shopfront Conversion) is also in decline, though it is improving. Whilst the rate of Year on Year decline in February 2019 is -1% on prior year, the November

2018 result reached its nadir at -4.7%. Black Friday delivered its promise to drive the bargain shoppers into store… just not as many stores as retailers would have liked.

The combination of these two elements means that retailers are having to cope with as much as a -18.4% change in their store traffic levels. This could well lead to catastrophic sales results. And those customers that do enter, are spending -7.6% less time in store. The impacts for merchandising and service focus can also be felt.

Thankfully stores have been able to offset most of this decline through huge boosts in the Sales Conversion. Once a customer has entered a store, their propensity to purchase has increased by as much as +18.2%. For those retailers that had a softer than desired Christmas 2018, contemplate the result you would have had if your staff, stores (not to mention your online assets to support consumer research pre-visit) had not delivered a +17% change in sales conversion.

The final piece that has returned sales for Australian stores into a marginally positive result is boosts in the average purchase value. These real aggregated figures show that a change in ATV of +3.8% are what is required to maintain

even the smallest LFL growth.

Your store staff are now facing vastly lower potential customers who are more aware of what they want, and willing to spend less time to find it. At the same time, they need to convert a greater proportion of them, and at higher values just to stay flat. Both simple and complex, all at the same time.

The ability for Australian retailers to respond to these changes are critical. Awareness of the underlying factors that deliver the sales capability and potential of stores is the starting point. Modifying and supporting positive behavioural shifts both at a store and support office level are now the fundamental drivers of sales parity.