Harvey Norman’s $34 million investment in dairy company Coomboona Holdings has soured, moving into receivership last Friday.

Harvey Norman’s $34 million investment in dairy company Coomboona Holdings has soured, moving into receivership last Friday.

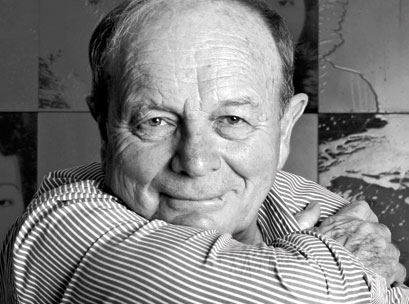

It comes after chairman Gerry Harvey came under fire at the electronics and white good retailer’s half-year result last month over a $20.7 million impairment on the business, with many analysts questioning the wisdom of the joint venture investment.

In a release to the ASX on Monday morning, Harvey Norman said that its wholly owned subsidiary, HNM Galaxy, which controls a 49.9 per cent stake in Coomboona, had appointed Ryan Eagle and Stewart McCallum of Ferrier Hodgson.

After moving into the hands of administrators National Australia Bank appointed Peter McKenzie Anderson, William James Harris and Matthew Wayne Caddy of McGrarth Nicol as the receivers and managers of Coomboona.

Coomboona, which began trading in September 2015, has been booking mounting losses since launching, including $4.57 million in trading losses for the first-half of FY18.

Harvey Norman’s interim net profit declined by nearly 20 per cent to $208 million last month, partly due to its impairment on Coomboona.

Harvey Norman had said that the impairment represented the recoverable amount of outstanding debt related to the investment and its equity.

Harvey, a director in Coomboona, defended the venture in February, saying that the the dairy business was a good investment that the market had misjudged.

But a dispute has also been breaking out between Harvey Norman and its joint-venture partner, as the company revealed last month.

A dispute has arisen between the HN JV entity and the Eternal Sound JV Entity in relation to a number of matters, including the future direction of the Coomboona JV,” Harvey Norman said in February.

“On 27 February 2018, the HN JV Entity demanded that the Coomboona JV repay outstanding indebtedness due by the Coomboona JV to the HN JV Entity in the sum of $18.51 million.”

More to come…

UPDATED – 12:00 AEDT

Access exclusive analysis, locked news and reports with Inside Retail Weekly. Subscribe today and get our premium print publication delivered to your door every week.